How Cryptocurrencies Work.

It’s true that the source codes and technical controls that support and secure cryptocurrencies are highly complex. However, laypeople are more than capable of understanding the basic concepts and becoming informed cryptocurrency users.

Several concepts govern cryptocurrencies’ values, security, and integrity.

1. Cryptography

Cryptocurrencies use cryptographic protocols, or extremely complex code systems that encrypt sensitive data transfers, to secure their units of exchange. Cryptocurrency developers build these protocols on advanced mathematics and computer engineering principles that render them virtually impossible to break, and thus to duplicate or counterfeit the protected currencies. These protocols also mask the identities of cryptocurrency users, making transactions and fund flows difficult to attribute to specific individuals or groups.

2. Blockchain Technology

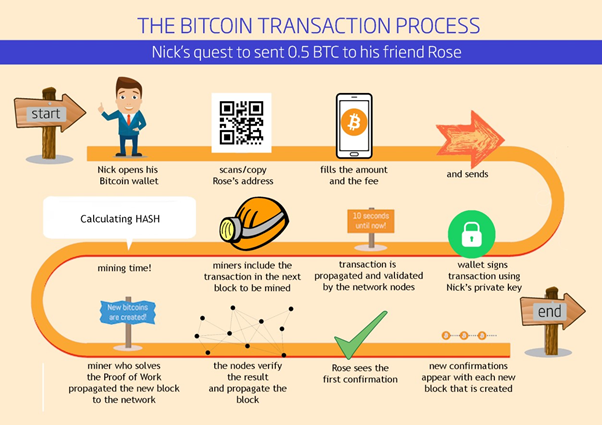

A cryptocurrency’s blockchain is the master public ledger that records and stores all prior transactions and activity, validating ownership of all units of the currency at any given point in time. As the record of a cryptocurrency’s entire transaction history to date, a blockchain has a finite length — containing a finite number of transactions — that increases over time. Identical copies of the blockchain are stored in every node of the cryptocurrency’s software network — the network of decentralized server farms, run by computer-savvy individuals or groups of individuals known as miners, that continually record and authenticate cryptocurrency transactions. A cryptocurrency transaction technically isn’t finalized until it’s added to the blockchain, which usually occurs within minutes. Once the transaction is finalized, it’s usually irreversible. Unlike traditional payment processors, such as PayPal and credit cards, most cryptocurrencies have no built-in refund or chargeback functions, although some newer cryptocurrencies have rudimentary refund features. During the lag time between the transaction’s initiation and finalization, the units aren’t available for use by either party. Instead, they’re held in a sort of escrow — limbo, for all intents and purposes. The blockchain thus prevents double-spending, or the manipulation of cryptocurrency code to allow the same currency units to be duplicated and sent to multiple recipients.

3. Decentralized Control

Inherent in blockchain technology is the principle of decentralized control. Cryptocurrencies’ supply and value are controlled by the activities of their users and highly complex protocols built into their governing codes, not the conscious decisions of central banks or other regulatory authorities. In particular, the activities of miners — cryptocurrency users who leverage vast amounts of computing power to record transactions, receiving newly created cryptocurrency units and transaction fees paid by other users in return — are critical to currencies’ stability and smooth function.

4. Private Keys

Every cryptocurrency holder has a private key that authenticates their identity and allows them to exchange units. Users can make up their own private keys, which are formatted as whole numbers up to 78 digits long, or use a random number generator to create one. Once they have a key, they can obtain and spend cryptocurrency. Without the key, the holder can’t spend or convert their cryptocurrency — rendering their holdings worthless unless and until the key is recovered. While this is a critical security feature that reduces theft and unauthorized use, it’s also draconian. Losing your private key is the digital asset equivalent of throwing a wad of cash into a trash incinerator. Although you can create another private key and start accumulating cryptocurrency again, you can’t recover the holdings protected by your old, lost key. Savvy cryptocurrency users are therefore maniacally protective of their private keys, typically storing them in multiple digital locations — although generally not Internet-connected, for security purposes — and on paper or in other physical form.

5. Cryptocurrency Wallets

Cryptocurrency users have wallets with unique information that confirms them as the owners of their units. Whereas private keys confirm the authenticity of a cryptocurrency transaction, wallets lessen the risk of theft for units that aren’t being used. Wallets used by cryptocurrency exchanges are somewhat vulnerable to hacking. For instance, Japan-based Bitcoin exchange Mt. Gox shut down and declared bankruptcy a few years back after hackers systematically relieved it of more than $450 million in Bitcoin exchanged over its servers. Wallets can be stored on the cloud, an internal hard drive, or an external storage device. Regardless of how a wallet is stored, at least one backup is strongly recommended. Note that backing up a wallet doesn’t duplicate the actual cryptocurrency units, merely the record of their existence and current ownership. If you don't know where begin to get a cryptocurrency wallet, I highly recommended that you sign up with Crypto.com app which is the best in the game in terms of security, updates and customer support.

6. Miners

Miners serve as record-keepers for cryptocurrency communities, and indirect arbiters of the currencies’ value. Using vast amounts of computing power, often manifested in private server farms owned by mining collectives that comprise dozens of individuals, miners use highly technical methods to verify the completeness, accuracy, and security of currencies’ blockchains. The scope of the operation is not unlike the search for new prime numbers, which also requires tremendous amounts of computing power. Miners’ work periodically creates new copies of the blockchain, adding recent, previously unverified transactions that aren’t included in any previous blockchain copy — effectively completing those transactions. Each addition is known as a block. Blocks consist of all transactions executed since the last new copy of the blockchain was created. The term “miners” relates to the fact that miners’ work literally creates wealth in the form of brand-new cryptocurrency units. In fact, every newly created blockchain copy comes with a two-part monetary reward: a fixed number of newly minted (“mined”) cryptocurrency units, and a variable number of existing units collected from optional transaction fees — typically less than 1% of the transaction value — paid by buyers. Worth noting: Once upon a time, cryptocurrency mining was a potentially lucrative side business for those with the resources to invest in power- and hardware-intensive mining operations. Today, it’s impractical for hobbyists without thousands of dollars to invest in professional-grade mining equipment. If your aim is simply to supplement your regular income, plenty of freelance gigs offer better returns. Although transaction fees don’t accrue to sellers, miners are permitted to prioritize fee-loaded transactions ahead of fee-free transactions when creating new blocks, even if the fee-free transactions came first in time. This gives sellers an incentive to charge transaction fees, since they get paid faster by doing so, and so it’s fairly common for cryptocurrency transactions to come with fees. Although it’s theoretically possible for a new blockchain copy’s previously unverified transactions to be entirely fee-free, this almost never happens in practice. Through instructions in their source codes, cryptocurrencies automatically adjust to the amount of mining power working to create new blockchain copies — copies become more difficult to create as mining power increases and easier to create as mining power decreases. The goal is to keep the average interval between new blockchain creations steady at a predetermined level. Bitcoin’s is 10 minutes, for instance.

7. Finite Supply

Although mining periodically produces new cryptocurrency units, most cryptocurrencies are designed to have a finite supply — a key guarantor of value. Generally, this means miners receive fewer new units per new block as time goes on. Eventually, miners will only receive transaction fees for their work, although this has yet to happen in practice and may not for some time. If current trends continue, observers predict that the last Bitcoin unit will be mined sometime in the mid-22nd century, for instance — not exactly around the corner. Cryptocurrencies’ finite supply makes them inherently deflationary, more akin to gold and other precious metals — of which there are finite supplies — than fiat currencies that central banks can, in theory, produce unlimited supplies of.

8. Cryptocurrency Exchanges

Many lesser-used cryptocurrencies can only be exchanged through private, peer-to-peer transfers, meaning they’re not very liquid and are hard to value relative to other currencies — both crypto- and fiat. More popular cryptocurrencies, such as Bitcoin and Ripple, trade on special secondary exchanges similar to forex exchanges for fiat currencies. (The now-defunct Mt. Gox is one example of an exchange.) These platforms allow holders to exchange their cryptocurrency holdings for major fiat currencies like the U.S. dollar and euro, and for other cryptocurrencies, including less-popular currencies. In return for their services, they take a small cut of each transaction’s value — usually less than 1%. Importantly, cryptocurrencies can be exchanged for fiat currencies in special online markets, meaning each has a variable exchange rate with major world currencies, such as the U.S. dollar, British pound, European euro, and Japanese yen. Cryptocurrency exchanges play a valuable role in creating liquid markets for popular cryptocurrencies and setting their value relative to traditional currencies. You can even trade cryptocurrency derivatives on certain crypto exchanges or track broad-based cryptocurrency portfolios in crypto indexes. However, exchange pricing can still be extremely volatile. For example, Bitcoin’s U.S. dollar exchange rate fell by more than 50% in the wake of Mt. Gox’s collapse, then increased roughly tenfold during 2017 as cryptocurrency demand exploded. And cryptocurrency exchanges are somewhat vulnerable to hacking, representing the most common venue for digital currency theft by hackers and cybercriminals like those responsible for taking down Mt. Gox.

Pro tip: Are you planning to start investing in Bitcoin or another cryptocurrency? Crypto.com is one of the largest platforms to trade Bitcoin and many other altcoins like Ethereum, Cardano and Dogecoin. Go check out here to get a $25 worth free of CRO coins upon sigining up for an account with Crypto.com app.